All bets are off after Breeder's Cup racing fix.

Gary West

The Dallas Morning News, 15 November, 2002

One normally thinks of horse race bets as bets that a specific horse will win, or will place (come in first or second), or will show (come in first, second, or third) or a "daily double" bet that a specific pair of horses will be the winners of two races.

In recent years, race tracks have introduced new forms of bets which are more like lotteries, called "exotic bets." These bets typically involve picking the winners of 3 or more races and have large prizes for success. This article deals with a "Pick Six" bet at the annual Breeders' Cup races, held on October 26th at Arlington Park. The Breeders' Cup races are sponsored by the National Thoroughbred Racing Association (NTRA) and are considered the "all star game" of horse racing because they attract the best racing horses throughout the world.

This year, the Breeders' Cup had 8 races and the Pick Six bet related to the last six races. A Pick Six ticket costs $2 and requires that you select a winner for each of the six races. You win if all six of your picks win their respective races. If you get only five correct you get a consolation prize. The pool for the prizes is obtained from the money collected from the Pick Six bets. The NTRA guarantees that it will be at least 3 million dollars.

The payoffs to winning tickets are determined as follows. Suppose that the total amount taken in by Pick Six bets is B. Then the NTRA takes 25% (1/4B) for themselves. The remaining 75% (3/4B) is again divided with with 75% (9/16B) to be divided among the Pick Six winners and 25% (3/16B) to be divided among those who got five correct as consolation prizes.

This year the amount taken in from Pick Six bets was $4,569,515. The track took its 25% leaving $3,427,136 to be returned to the bettors. Taking 75% of this gave $2,570,352 to be divided among the winners and the remaining 25%, or $856,784, to be divided among those who got 5 correct. For this years race 6 winning tickets were sold and 186 tickets were sold that got five correct. Thus each winning ticket got $428,392 and each consolation ticket $4,606.20.

The winning six tickets were all bought by the same bettor, Derrick Davis, owner of a computer business in Baltimore. Davis specified the winners for the first four races and then chose every possibility for the 5th and 6th races. There were 8 horses running in the 5th race and 12 in the 6th, so Davis had to buy 8x12 = 96 tickets to cover all possibilities for the 5th and 6th race. This would assure that he would have a winning ticket if his choices for the first 4 races were correct. He actually bought 6 of these sets of 96 costing him $1152. This assured him a bigger fraction of the money designated for the winners money if he did win. His picks for the first four races all won, so he ended up with 6 winning tickets. It turned out that there were no other winning tickets so he qualified for the entire winners' money, $2,570,352. He also had 108 tickets with five correct. This qualified him for a total winning of $3,067,820.

The NTRA was suspicious about these bets. They thought it strange that a bettor would make six replications of the same set of tickets and also put all the money on a single choice of winners for the first 4 races. Their investigation led them to look into Davis' past. They found that he had two friends, Glen DaSilva and Chris Harn, who were fraternity brothers when the three of them were in college at Drexel University. The investigation led to the three friends being charged with fraud and Davis' winnings being held up. Here is the basis for this charge.

Chris Harn was a computer expert who worked for Autotote company which processes a large proportion of the race track bets. To avoid computer congestion at the race track, only the bets that are still possible winners after the first four races are sent on to the track. They are sent after the fourth race and before the beginning of the fifth race. Harn had access to the betting data and is charged with changing the bets on the first four horses to make them agree with the winners before they were sent on to the track. The Dallas Morning News web site provided the following nice graphic to show how this could have happened:

Harn is also accused of performing the same service for DaSilva, who won $1,851.20 in a Pick Four wager at Baltimore Park on Oct. 3, and $105,916 in a Pick Six bet at Belmont Park on Oct. 5. DaSilva used the same strategy of picking single winners in the early races and then every horse in later races. Harn, Davis, and DaSilva were charged with fraud under Title 18 Section 1243 of United States Code.

Section 1343. Fraud by wire, radio, or television Whoever, having devised or intending to devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises,

transmits or causes to be transmitted by means of wire, radio, or television communication in interstate or foreign commerce, any writings, signs, signals, pictures, or sounds for the purpose of executing such scheme or artifice, shall be fined under this title or imprisoned not more than five years, or both. If the violation affects a financial institution, such person shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both.

The US Attorney who brought the charges claims that phone records showed that Harn was communicating on his cell phone with Davis during the time the Breeders' Cup races were going on and computer records show that Harn came to Autototes's headquarters, even though he was not scheduled to work, and electronically accessed the computer file that held Davis' wager.

We wondered what evidence the defense attorney could give to combat this rather impressive circumstantial evidence. For starters we thought he might try claiming that Davis just wanted Hahn to check to make sure his bet was actually received. As to how strange his bet was, we wondered what systems were used and how often it happens that there is at most one winner in the Pick Six bet. The Pick Six bet for the Breeders' Cup races has only been available since 1997. Here are the numbers of winners and the payoff information for the races up to 2002.

Number of winning tickets and payoff for Breeders' Cup races 1997-2002.

Thus we see that their lawyer would have a precedent. In 1999 G. D. Hieronymous--a videographer with a Breeders' Cup newsfeed team-- held the only winning ticket for the Pick Six bet. He created a strategy for a group of his fellow workers. His strategy was to pick two horses in the first and second races, three in the third race, and two in the last two races that he thought had a good chance to win. Thus he had to bet on 2x2x3x2x2x2 = 96 possible outcomes which cost him $192. He had the only winning ticket and won $3,088,138.60.

To compare his strategy to that used by Davis, we need to show how to evaluate a particular strategy for buying Pick Six tickets. For this we need to estimate the expected winning using a particular strategy.

We consider first how we might estimate the probability, before the race, that a particular Pick Six ticket is a winning ticket. It is reasonable to assume that the races are independent events, so we only need to estimate the probability that each of the horses picked win the races they are in.

Odds are given for the win bets so we can use these odds to estimate the probability that a particular horse wins a race. For example, if the odds given that a horse will win are 4 to 1, this corresponds to a probability of 1/5 that the horse will win.

We will find it useful to know how the track determines these odds. Here is a description, provided by our friend the "The Wizard of Odds", of how the odds for a "win" bet would be calculated for a particular horse, for example Longwind.

Assume that $1000 is bet on the "win" bets. The track takes its cut which is typically between 15 and 20 percent. Assume that it is 17%. This leaves $830. Now assume that $200 was bet on Longwind. Then the track divides 830 by 200 getting 4.15. It then returns $4.15 for each $1 dollar bet on Longwind if he wins. In this case the bettor wins $3.15 for every dollar bet on Longwind. This determines the odds on Longwind as 3.15 to 1. From this we estimate that the probability Longwind will win is 1/(1+3.15) = 1/4.15 = 200/830. If $300 were bet on another horse the probability that this horse would win is 300/830.

If we add these probabilities for all the horses, we get 1000/830 = 1.205 instead of the 1 we would expect from our estimates of the individual probabilities. So we have to normalize these probabilities to add to one by dividing them by 1000/830. When we do this the probability that Longwind wins is 200/1000 = 1/5. More generally, if b is the amount bet on a horse and B is the total amount bet on win bets then our estimate for the probability that this horse wins is b/B. Thus our estimate for the probability that a horse wins is just the proportion of money bet on this horse.

When the track publishes the odds, they normally round them off to one decimal place, rounding them down. This gives the track a little more money and makes our estimates using these odds not quite correct.

These probabilities, based on the amounts that the bettors bet on the horses, are subjective probabilities. How do we know they are reasonable estimates for the probability that a horse will win? Fortunately, Hal Stern has studied this question and was led to the conclusion that these subjective probabilities are really pretty good. As reported in Chance News 7.10, in his column "A Statistician Reads the Sports Pages" (Chance Magazine, Fall 1998, 17-21) Hal asked: How accurate are the posted odds? To answer this he considered data from 3,784 races (38,047 horses in all) in Hong Kong. He divided the range of odds into small intervals and for each interval found the proportion of times horses with these odds won their race. Here is a scatterplot of his results:

Correlation of the subjective estimates of the probability a horse will win with the empirical frequency that the horse wins.

As you can see the fit is remarkably good.

We return now to finding the probability, before the races begins, that a particular Pick Six betting strategy is successful and use this to find the expected winning for a particular strategy.

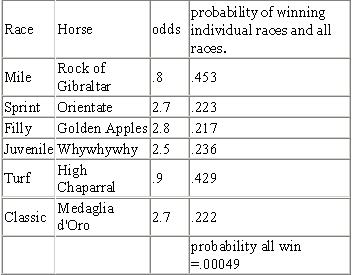

Assume first that we purchased a single Pick Six ticket. For this we specified a horse in each race that we think will win. As we have remarked, it seems reasonable to assume that the winners of different races are independent events. So from the posted odds for the races we can determine the probabilities for each horse winning and multiply these to get the probability that we have a winning ticket. For example, for a Pick Six bet in the 2002 Breeders' Cup races suppose we were to bet on the horse with the highest probability of winning in each race. We can find the relevant win bet odds from the NTRA web site. Using these we find the horses in each race with the highest probability of winning to be:

Data for determining the probability of winning a Pick Six bet on the favored horses for the Breeders Cup 2002 races.

We see that for this bet we have a winning ticket with probability .00049. Using the probabilities for winning each race we find the probability of getting exactly 5 correct to be .0137.

We now show how we compute the expected winning for for a general strategy using multiple bets. Recall that if B is the total amount bet on Pick Six bets, (9/16)B is divided amount the winners and (1/16)B is divided amount those who got five correct.

Since the payoff depends on the number of bettors with winning tickets, to calculate the expected winning we have to know how many winning bets there are for each choice of 6 horses to win. However, in this year's races, there were 1,585,584 ways to choose six horses to win so it is not surprising that this information is not available from the NTRA web site. Thus we must estimate these numbers. We do this by estimating that the proportion of bettors who bet on a particular choice six horses is equal to the probability that these 6 horses win. This is what Hal showed was reasonable for the "win" bets. With this assumption we can compute the expected winning from a single ticket.

Assume now that we make a Pick Six bet. Let p be the probability that our choice of horses win and q the probability that our choice was wrong in just one race. Then, by our assumption, the number of bettors who bet as we did is pB and the number who bet on a choice that differs only by one from ours is qB. Thus if we win our payoff is (9/16)B/pB= (9/16)/p and if we get all but one correct it is (3/16)B/qB = (3/16)/q. So our expected winning is

E = p(9/16)/p + q(3/16)/q = 9/16 + 3/16 = 3/4.

Thus our expected payoff is 75 cents for each dollar spent on tickets and this is the same no matter which horses we choose for our ticket. Of course the expected winning is - 25 cents since we paid $1 for our ticket. Since the expected payoff for any bet is the same, the expected payoff for any strategy involves buying the same number of tickets. Thus Davis' lawyer could argue that his clients strategy was as sensible as any other strategy which involved buying the same number of tickets!

The fact that no strategy is any better than any other with the same number of tickets is rather surprising, so it is natural to ask how reasonable is our assumption that the proportion of bets on a specific choice of winners is equal to the probability that this choice wins. One can argue that horse racing bets are like buying stocks. If one could find a strategy for making money buying particular stocks, then others would do the same, and the price of the stock would go down. If a horse-racing wizard figured out a more favorable way to bet, others would learn of this and do the same making the winnings less and bringing the distribution of bets back to the equilibrium situation where no one has an advantage. On the other hand, one can also argue that, given the large sums of money one can win, bettors utility function might affect their betting. For example, more bettors might include a long shot, in the hopes that they will not have to share the winning.

It would be nice to have enough data to check this assumption, as Hal did for the "win" bet. Unfortunately, we do not have this data. We do have a very small amount of data where we can compare our predicted number with the actual number of tickets sold. News accounts typically give the number of the winning tickets. We found these numbers for the 6 years that the NTRA has had the Pick Six bet. Here is the comparison for these years.

Comparing the umber of winning tickets with the number estimated

The fit of the predicted values of tickets and the actual number of tickets is not great, but then it is not bad either and, as we know, six data values do not tell us much.

Note that the Breeder's cup officials have decided that there were no winners this year. This presumably means that the the 78 legitimate winners of the consolation prizes would divide the entire $3,427,136 that had been set aside for the Pick Six prizes. This would give them about ten times as much as they had won, $43,937.6 instead of $4,606.2. They can be identified since they had to sign a federal tax identification form to get the winnings.

Well, we did not succeed in our attempts to save our computer friends from time in jail but perhaps we provided an interesting example to use in your statistics courses.

Final note: By the time we finished this long treatise, all three of the fraternity brothers pleaded guilty and sentencing is scheduled for March 11.

No comments:

Post a Comment